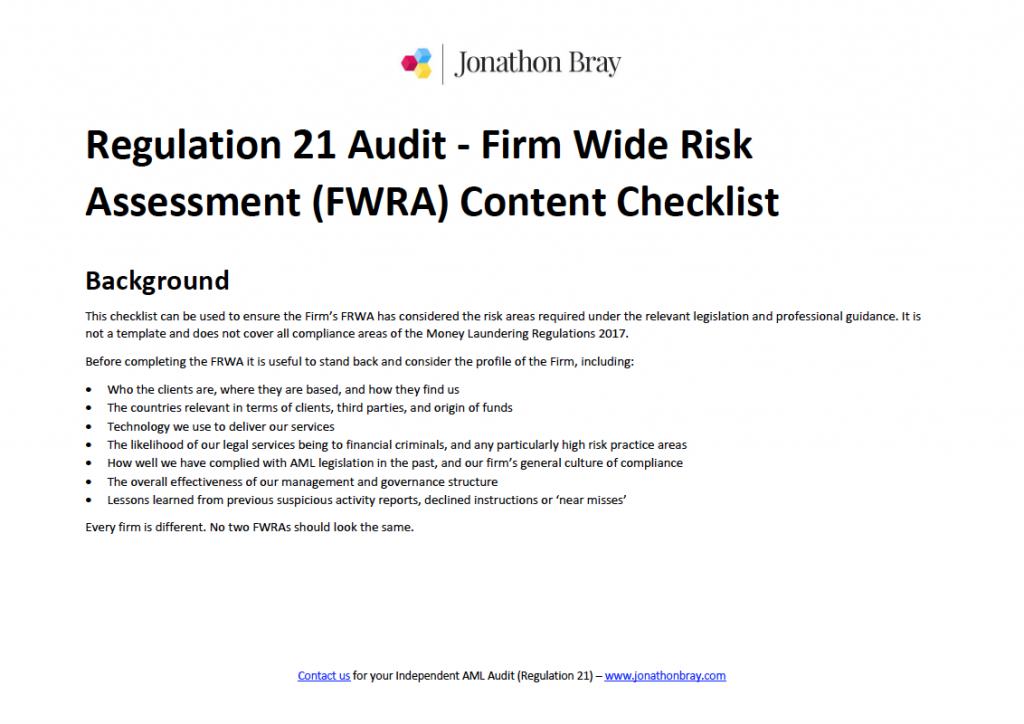

Updated 25 July 2023

Regulation 18 of the Money Laundering Regulations 2017 requires all law firms (subject to the Regulations) to have in place an AML firm-wide risk assessment.

The official anti-money laundering guidance for the legal sector describes this high level risk assessment as the ‘cornerstone’ of anti-money laundering compliance. Not only does it demonstrate that you have been through the required analysis, but it informs all of your firm’s policies, procedures and controls.

And since it needs senior management sign-off, it is an essential part of establishing an AML culture.

The SRA puts a huge emphasis on the importance of the firm-wide risk assessment. It is the first document they will want to see when they spot check your firm.

But what exactly needs to be in the AML firm-wide risk assessment?

The precise requirements can be found in:

- Sectoral Risk Assessment – Anti-money laundering and terrorist financing (24 July 2023)

- Legal Sector Affinity Group (LSAG) – Anti-money laundering guidance for the legal sector

- The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017

We have summarised main points in this PDF checklist:

![What should be in your law firm’s AML Firm-wide Risk Assessment? [Checklist] What should be in your law firm’s AML Firm-wide Risk Assessment? [Checklist]](https://www.jonathonbray.com/wp-content/uploads/bfi_thumb/dummy-transparent-obadi0wivgww4ihdae9xs8qbf69cenia3a5vcdxo0e.png)